FOMC Debrief + Housing Vibe-Check

My Top 3 Takeaways from the FOMC Press Conference:

1) Jay Powell is absolutely not submitting to the balrog that is Trump: Markets were expecting a relatively dovish Powell after Trump visited him at the Fed (and gave him "friendly slap" on the back). Perhaps not surprisingly, Powell continued to show his steely resolve and absolutely refused to concede anything at the meeting.

IN FACT, he even clapped back at Trump, suggesting he's already doing him a favor:

You could argue we are a bit looking through goods inflation by not RAISING RATES

Basically a "PLEASE get ALL THE WAY off my back" to Trump.

2) Powell continues to have blinders on regarding the housing market: Several times, Powell was asked about housing outright and he basically said "sorry not my problem." In fact, he even made some intellectually suspect remarks that the Fed's policy does not have a strong effect on mortgage rates (which I think is a bit of a stretch).

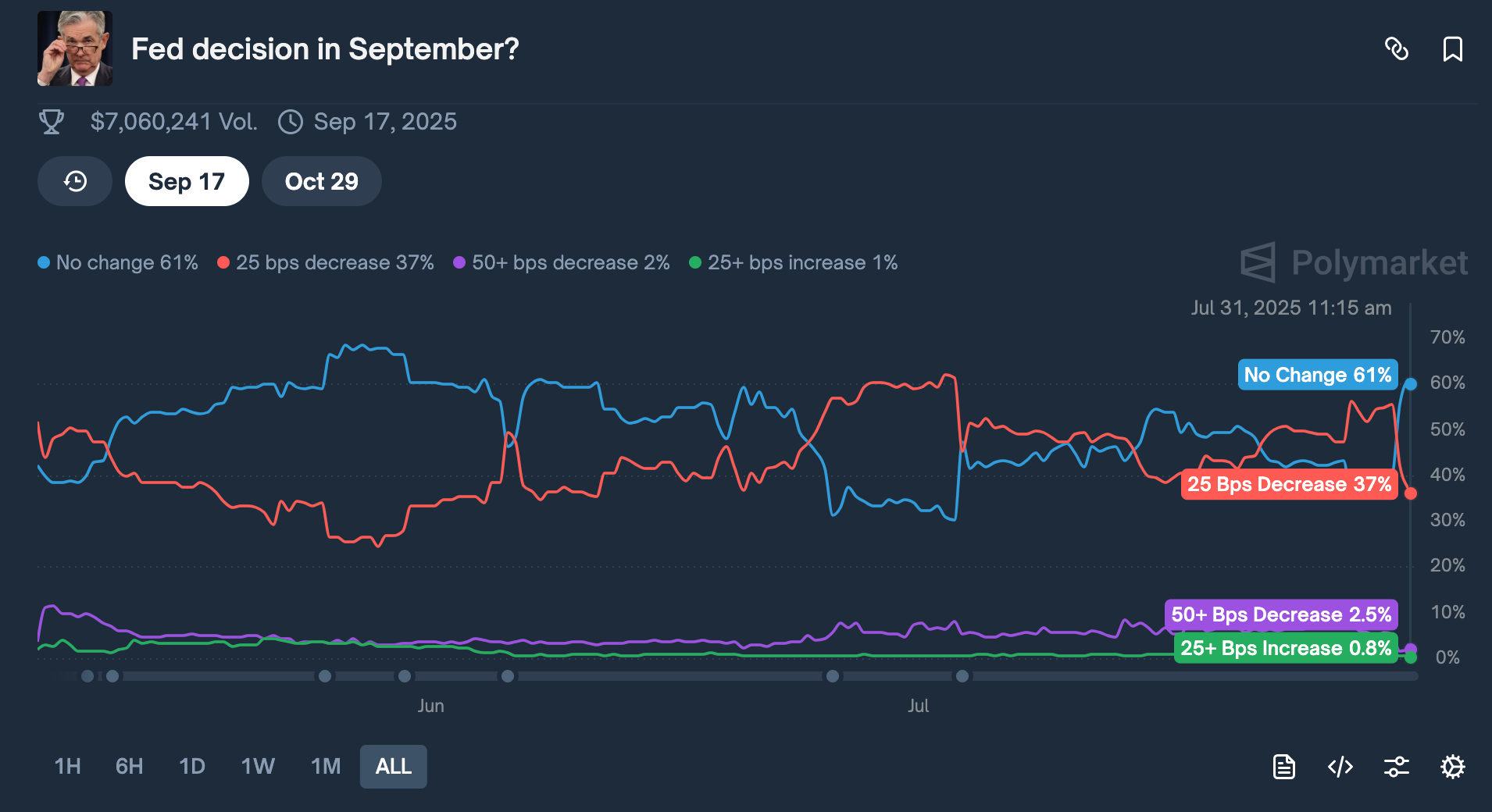

3) Get ready for September fireworks: My personal read is that if the data continues to come in muddy around the labor vs. inflation trade-off, Powell will be inclined to continue holding in September. IF that happens, I imagine Trump is highly likely to resort to even more heavy-handed tactics. The POTUS is not someone who likes to be defied for long and by September, his patience will have worn quite thin.

All-in-all, a good meeting for American institutions but unfortunately not great for $OPEN. As such (despite the administration's best efforts), it seems unlikely that the macro cavalry is coming to rescue Opendoor.

Quick Housing Vibe-Check:

Mortgage rates stay steady but elevated in the high-6's. Every time the 10 year dips below 4.3%, a data read comes out and pushes it back to within the 4.3% to 4.5% band. Listening to Powell + all the pundits out there, everyone basically agrees "it's too f*cking complicated" right now and that no one really knows what's going to happen by September (specifically in terms of the inflation vs. labor dynamic).

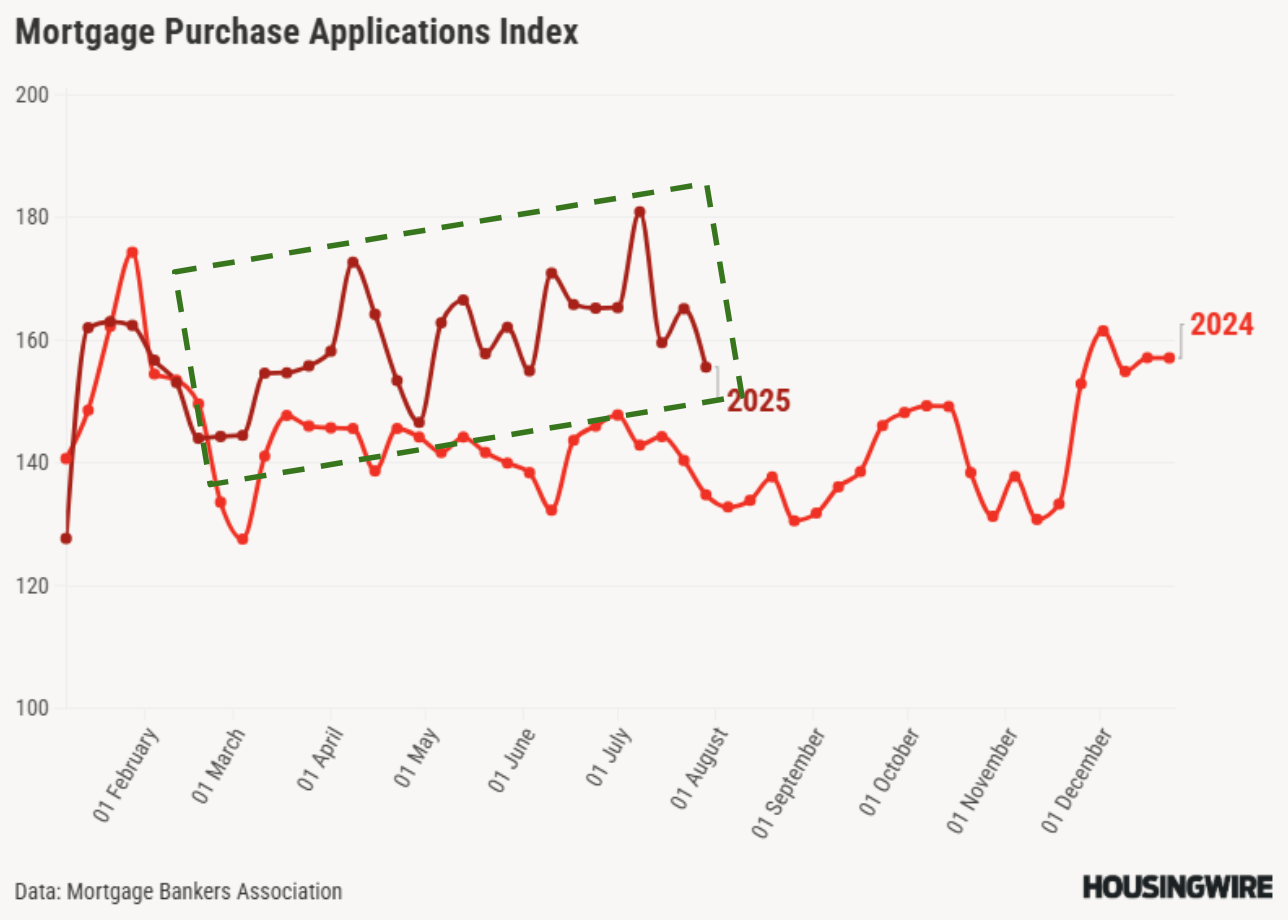

I do believe though that "pent-up" buyer demand continues to build (which I'll cover in a future article). Mortgage purchase applications continue to be strong DESPITE current rates, hinting at a volcano of demand bubbling under the surface.

In Conclusion:

My final thought is that waiting for macro to save Opendoor has been a lot like Waiting for Godot - the belief that something is coming to save the company has led to a sort-of nihilistic passivity. There needs to be a reframe of the company's ability to determine its own destiny and hopefully we see that on August 5th.

Stay tuned tomorrow for my full Q2 Opendoor Earnings pre-read and what I'm going to be specifically watching out for.

Please subscribe if you liked this article!

I've been a die-hard Opendoor follower, employee, and shareholder since I joined the company in 2016. In many ways, the company has defined my professional and personal career. Currently, I work at DeepSky (founded by former Opendoor alum) where we're building the next business super-agent.