Opendoor Q3 2025 "Financial Open House" Preview

This will be the most consequential earnings for Opendoor ever (since the last one). Basically, it's going to determine whether the company has truly hit an inflection point and the stock has legs to break $10 or will continue to be stuck between $5-10 (till next year at least).

As a caveat, although I do present a pretty optimistic picture of earnings below, I just want to remind readers that $OPEN has already almost 20x'd from $0.50 June lows and 4x from post-Q2 earnings. To a large extent, the market has already priced in a generational turnaround from Kaz - the only question now is whether it's under-priced how quickly and aggressively his team can execute.

So NFA.

Let's get started - here are the 4 things I'll be looking for from earnings on Nov 6th.

Acquisition guidance

The most important number I'll be watching (and I suspect everyone else too) is how much Kaz and the team push up acquisition guidance for Q4 and 2026. Kaz has made it eminently clear every time he's spoken publicly that he doesn't feel like the way to run Opendoor is at 15+% spreads - this is what he calls the "hedge fund" model of trying to find significant home mispricings at scale (which he doesn't believe is possible). He's much more of the idea that Opendoor is a market-maker - this means it absolutely needs volume to survive.

That clearly implies that he's bringing spreads down, acquisitions up, and revenue / growth up as a result. The only question is how low will they be willing to push spreads down so early in the game. Rather than try to guess at a number, I'll lay out some reasons to keep spreads higher vs lower.

Reasons to keep spreads on the higher side (still >10% on average):

- Give the team time to ramp into volumes, especially given potential personnel turnover

- Mortgage rates are down but not below 6% yet, meaning buyer demand is better but not a game-changer yet

- Any sort of buyer initiatives or programs to improve resale velocity likely haven't had much time to take effect and they'll be going out on a limb baking in any resale improvements

- Seasonality means a large cohort of homes purchased in Q4 will be listed in Q1 - a traditionally slower time of year. Normally, spreads would be still be higher than average to adjust for this

Reasons to push spreads down aggressively:

- Significantly reduces adverse selection effects of always trying to lowball sellers

- Allows Opendoor to capitalize on current retail sentiment and brand awareness and more efficiently use marketing dollars

- Belief that mortgage rates will continue to go down and positions the company well to benefit from potentially strong 2026 housing demand (essentially a mortgage rate bet)

- Keeps stock price and sentiment high by signaling growth and confidence in execution

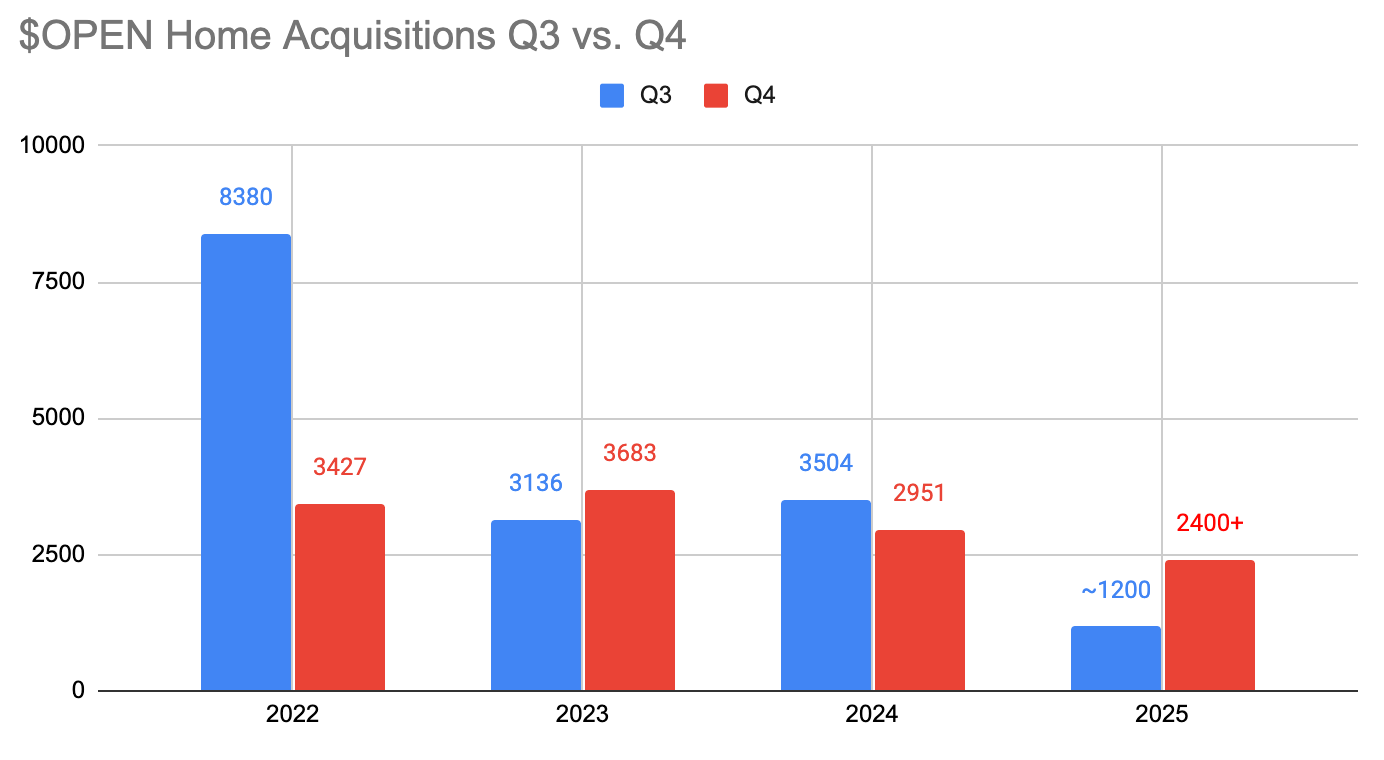

To give you a sense of the historical range - 2024 Q4 vs. Q3 acquisitions were down 16% as Carrie and the team hunkered down to save cash (and had gotten burned in scaling the previous year). On the other hand, in 2023 Q4 vs. Q3 - the team actually purchased 17% more homes as they expected the housing market to rebound.

From a very low base of the 1200 homes Q3 2025 acquisition guide, I expect Kaz to easily beat that 2023 +17% number. In fact, I wouldn't be surprised if they even doubled (+100%) to something like 2400+ homes as that would still be 500 homes LESS than they purchased in Q4 2024.

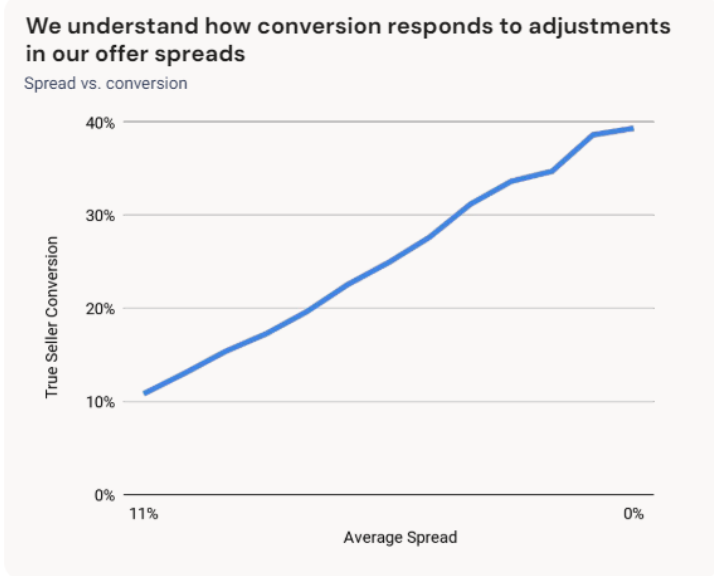

My $0.02 is that Kaz is going to aim for the fences and bring spreads down VERY significantly. I always come back to this chart which outlines seller conversion vs. spread. Ironically, it doesn't really even go above 10% since the company didn't have great data for offers that high at the time (2021 / 2022). However, if I totally eyeball it - at 15% spreads - it seems likely that true seller conversion was probably about low to mid-single digits. At 6% spreads, that number looks closer to 25% (or a 5x increase). That means Kaz has a clear growth knob to turn (price) where he could easily double or triple volumes just by bringing spreads in to a more reasonable range.

Nothing about him so far from interviews or X strikes me as a guy who likes to hedge his bets - let's see if my hunch is right.

Margin guidance

The other side of the coin to revenue growth is obviously margin. The margin guidance components will come down to two parts - opex and contribution / gross margin.

Opex guidance - I predict the savings here to be pretty spectacular. Basically on all three major categories - Kaz has been pretty clear that he's taken a "zero-based" budgeting approach. Marketing, G&A, and headcount have all been completely rethought from first-principles. Some rumors have suggested that headcount has been reduced by as much as 50%. This seems on the higher end but I do think it's possible / even likely that they've cut marketing and G&A spend by 50%.

Quick back-of-the-envelope: LTM Q2 2025 Opex was about $640M and LTM Q2 2025 NI Loss (GAAP) was about $300M. Is it possible that Kaz has cut 40-50% and $OPEN could already be run-rate breakeven on a GAAP-basis just from opex savings?

Crazy to say but I actually don't think it's impossible.

Gross / contribution margin guidance - This one is a lot trickier. Ultimately, it comes down to too many assumptions to count but I have to imagine that the lower they push spreads, the lower they're going to have to guide on contribution margin (at least for now). My guess is that they maybe target CM breakeven and go for gangbusters volume heading into 2026.

Q2 2025 CM (adjusted) was 4.4% so that gives them a bit of room to lower spreads assuming 1 to 1 passthrough (should be a bit better assuming less adverse selection) but if Kaz really does go for 6-8% spreads then the math is going to be pretty tricky to get the CM numbers to work. Ultimately, they're going to have to bake in either a pretty big macro / HPA lift or all the various buyer initiatives are going to have to really pull their weight.

Business model diversification - Referrals / Key Agent

Personally, I feel like I've gotten mixed messages as to whether the referral model will be around in the medium-term. Keith has explicitly said no, while Kaz has demurred and said that Opendoor will have both asset-light and asset-heavy products and services (see 20VC interview).

Ultimately, I have no idea what the revenue mix looks like beyond ibuying or what they're going to guide towards for Q4 2025 / 2026. In the Q2 earnings, Carrie said that Key Agent was doing extremely well and it was just a matter of onboarding more agents and scaling out to more markets. However, the financial impact at the time was inconsequential. I'm not clear whether Kaz has continued down this route or trimmed the program at the behest of Keith.

Also, I don't understand what the "launch" to all 50 states looks like. This must be through partner agents so it's possible the key agent program has gone in a completely different direction.

Should be really interesting to see what guidance here will be like and whether the team expects it to be a meaningful contributor to the business in the short-term.

Wild cards + partnerships (Robinhood, crypto, etc)

To close, I feel like I have to mention the potential wild cards that are all on the table.

Convertible note - I won't go into the details around the note but it's obvious current management is not happy having to deal with this (probably why Selim got kicked to the curb after Carrie). I would love if the company gave an update on the note and if they have plans to restructure it or work with the current owners of the notes on longer-term arrangement. It's definitely a big unknown currently who owns these shares and what the dilution consequences might be.

Robinhood partnership - This one consistently comes up on X and I wouldn't be surprised if there are some discussions behind the scenes happening. However, it does feels a bit too soon for them to announce anything. Maybe an acquisition in 2 years though at $82?

Crypto - Kaz has explicitly said he believes Opendoor should accept crypto but there are other priorities first so again I would be surprised if they announced anything here so quickly. This is also an area where they could do partnerships (especially with several startups in the space) but currently its all very speculative.

Mortgage - I actually think there's huge potential for Opendoor to innovate on the mortgage side. Whether its assumable mortgages or buydowns or lease-to-own, I would love for them to announce some programs to improve buyer affordability. There's already been some signs they're partnering with Roam and would be interesting if they make that into a full-blown announcement.

Trump - Finally, I'd be remiss to not mention potentially Eric Trump or someone else close to the administration announcing a stake in the company. Again, likely small chance but not out of the realm of possibility - housing is a core issue for voters and Opendoor just happens to be the most talked about housing company out there right now - perfectly positioned to help increase / support home-ownership.

Opendoor earnings will be on Nov 6, 2025 at 5:00 PM ET. See you there!