Q2 2025 Opendoor Earnings Expectations

"There are decades where nothing happens; and there are weeks where decades happen" - Lenin

After 3 sleepy years, the last few weeks for Opendoor have certainly felt like decades. In that vein, this Q2 earnings call will be the most important for management (to prove their mettle), retail (to reignite sentiment), and Wall Street (to rerate the business), since 2022.

Defense or Offense?

It's been clear to anyone listening to the last 3 years of earnings calls, that the company's general strategy has been to set C-minus goals and achieve C results. Tough macro, tough macro, tough macro has been the story every call - leading to the diminished business seen today.

Imagine now if Carrie opens with: "We are committed to re-catalyzing growth through all macro environments with our new Key Agent, Cash Plus, and AI innovations"

mic drop

This narrative shift is the #1 question in my mind; namely, will management signal a transition to "offense" in H2?

I would have said unlikely even 3 weeks ago, but with recent developments, the stars seem to have aligned for the team to take a bigger swing.

What I'll Be Listening For:

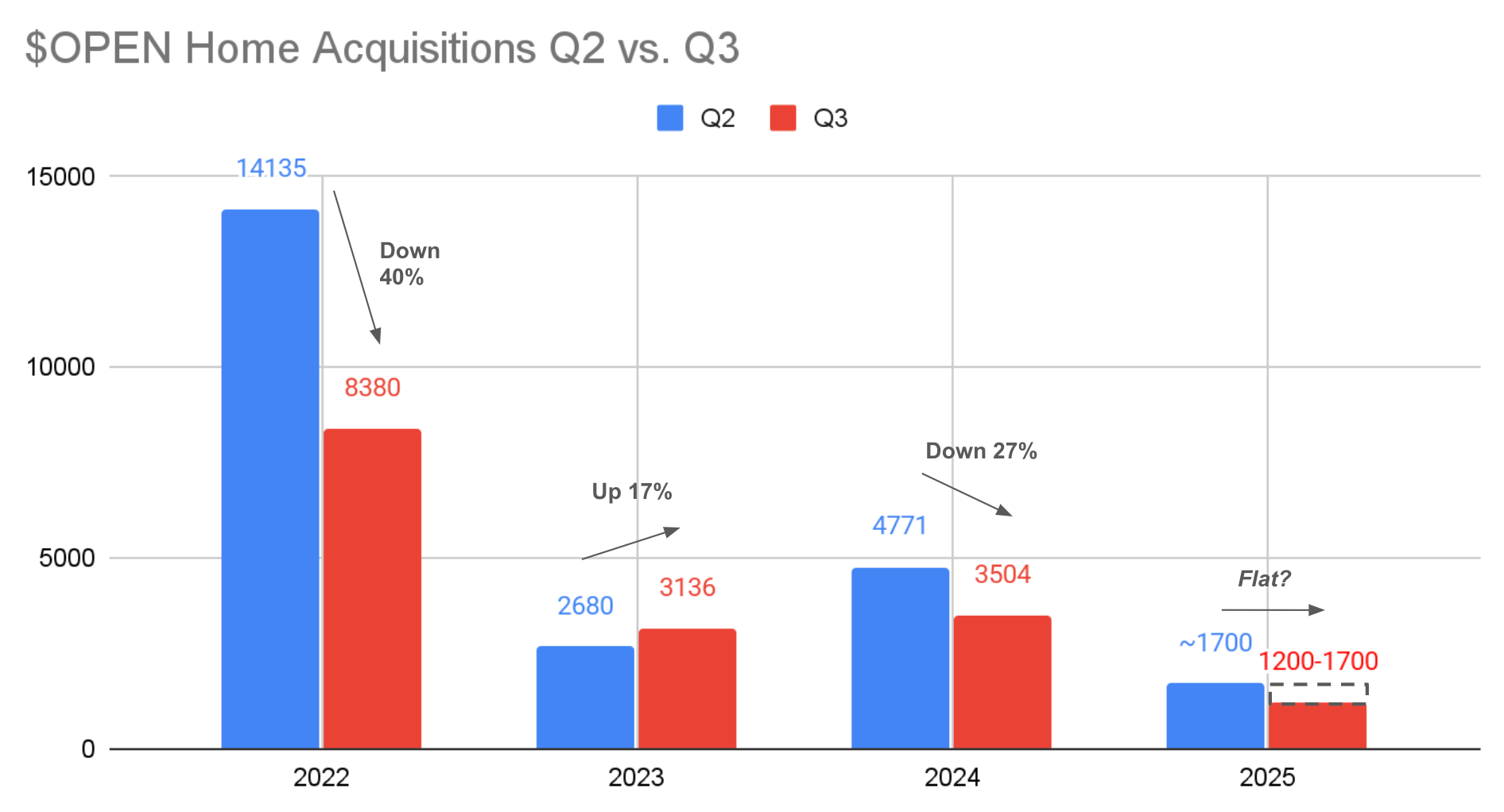

1) Acquisition Guidance for Q3: In my mind, the most important number to watch out for will be Q3 acquisition guidance. This quarter's purchases are the next 2 quarters' revenue so this will be a huge signal around how management is thinking about stepping into "offense." Specifically, whether they truly believe that Key Agent and Cash Plus will be able to move the needle in conversion.

Given Opendoor's commentary last quarter around leaning into seasonal housing trends (ie. listing fewer homes during the slower winter season), the likely guidance will be probably be something flat to slightly down from the ~1700 acquisitions made in Q2. Any Q3 acquisition guide ABOVE what they purchased in Q2 would be very positive in my mind, signaling confidence despite tough macro.

2a) Key Agent Ramp and KPI's - The 2nd most important metric will be the incremental conversion lift from offering the Key Agent program to prospective sellers. In terms of reigniting the growth story, any meaningful lift in monetizing sellers leads will have a huge impact on Opendoor's marketing efficiency and ability to grow even at high spreads.

Analysts will be especially eager this time around given the recent media attention and will likely try to dig into as much detail as possible; so I'm personally very excited to see what the early "encouraging" data looks like.

2b) Launch of Cash Plus - Not as much has been announced around Cash Plus but if done correctly, this is yet another way for Opendoor to increase seller conversion and ultimately reduce overall spreads (by limiting losses from "left tail" lemons). I'll be on the watch out for similar KPI's to the Key Agent program; again if they expect this to help them grow acquisitions through the slower season.

3) Profitability: Q2 Adjusted EBITDA will come in at or above guidance but the real guide will be for Q3. The Street and Datadoor both have Opendoor back to negative adj. EBITDA in Q3 and Q4 and my hunch is that management is probably unlikely to guide towards positive adj. EBITDA given seasonality. However, this could potentially be another positive catalyst if they're willing to be a bit more aggressive and guide towards at least breakeven in Q3.

Wild Cards:

Leadership Changes: Unlikely, but certainly possible. I would say there's a small chance that Carrie announces her step-down as CEO to just Chairwoman of the Board, with Amit (or MAYBE Selim) (UPDATE: I just learned Amit has recently left so I guess we'll see if there are actually any significant changes) stepping into the CEO role. I think overall Carrie's been a good steward of the ship but certainly the pressure is ramped up now and the jury is still out in terms of whether she can navigate the company through this next phase.

AI Initiatives / Partnerships: From my previous article, it should be apparent now that I feel that the company is likely behind in implementing AI into the business. I don't expect the company to announce any significant AI partnerships or developments this call but I imagine they may pay lip-service to looking to implement LLM's into their pricing model or "exploring partnerships." If they do announce anything big - expect fireworks.

Acknowledging and Leveraging Retail Sentiment: Lastly, I would love to see management, specifically Carrie, acknowledge the recent growth in retail sentiment and make some suggestions around how they're planning on leaning into this increased attention.

One "crazy" idea would be to cut ALL paid and brand marketing spend but move that money into paying down mortgage rates for prospective buyers who have Opendoor shares and are looking to buy an Opendoor home. This would be a huge narrative shift in terms of helping buyer affordability and may even get the administration on the company's side.

Buckle up Aug 5, 2025, 2:00 PM PT - should be a fun one.

Please subscribe if you liked this article and want to learn more about Opendoor

I've been a die-hard Opendoor follower, employee, and shareholder since I joined the company in 2016. In many ways, the company has defined my professional and personal career. Currently, I work at DeepSky (founded by former Opendoor alum) where we're building the next business super-agent.