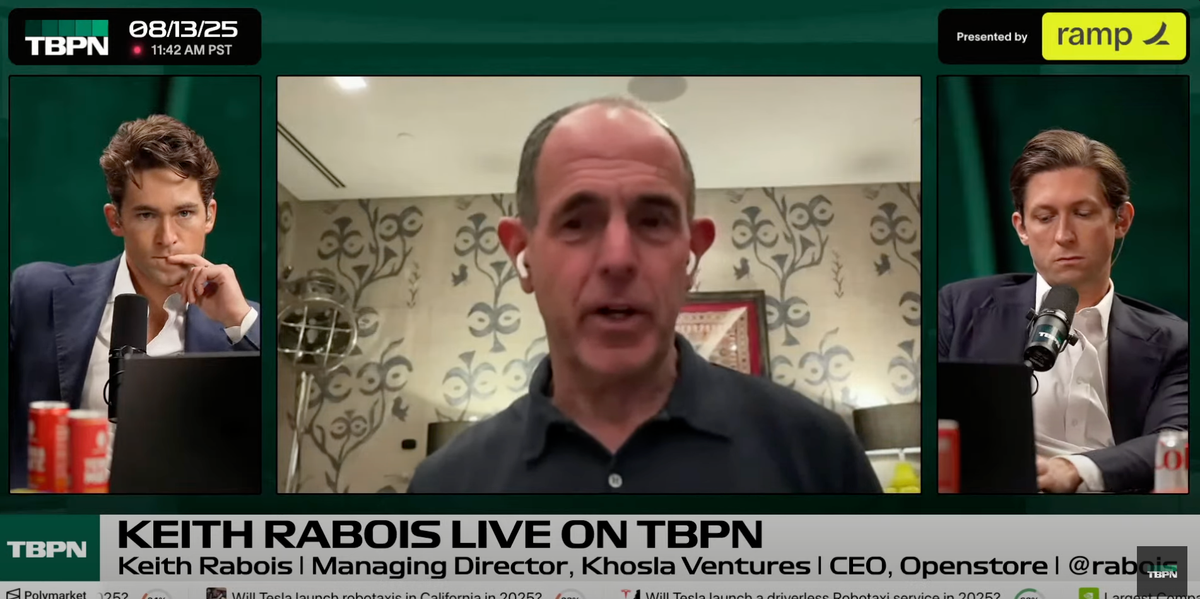

Quick Analysis - Keith Rabois Interview on TBPN

Only ~10 minute long section but Keith had many interesting thoughts and takes on the business. Worth a full listen but I pulled my favorite quotes below.

Let's see if / how Carrie responds on the Pomp Podcast!

Key Quotes:

"Yuri Milner actually made this point to me seven years ago. The largest real estate platform in the west is worth about $18 billion. That's insane. This is the largest asset class, period. The idea that the most innovative company in the entire Western universe would be worth $18 billion in residential real estate makes no sense whatsoever.

So somebody's going to build a 50, 100, $150 billion market cap company and this management team doesn't think that way. They think about, you know, moving one basis point here, one basis point there versus innovating to build $100 billion company. There is no reason [Opendoor] shouldn't be a 50 to $100 billion company."

I won't comment on Keith ripping into management but 100% agree that it makes no sense that the two biggest residential "proptech" companies Zillow and Rocket Mortgage, even now, are both only worth $20 and 40B respectively.

It should be patently obvious the real prize is still yet to be won.

"Well, I think that's why we need a CEO who's AI. Native AI. Insightful. I think that business transformation requires real skill"

Can Carrie learn AI? We shall see.

"We should be innovating so that there's no comparison. Like the value proposition Opendoor provides a consumer. Whether a buyer or seller should just be so much better that nobody wants a real estate agent. It's not a bad thing. Like real estate agents used to do. X and Y, there's a bundle of services they provide. But when Opendoor provides this, it's just like a no brainer. And if it's not a no brainer, the company is not innovating and it's not creating enough value, period."

I think Carrie wouldn't actually disagree with this statement - she also wants Opendoor to be the "no-brainer" first-stop for home sellers. The only difference is that agents are now a core part of the puzzle instead of dis-intermediated. We'll see how it plays out.

"I think retail investors having a point of view and being excited about an opportunity is a great thing. I think the whole point of markets is to allocate capital. That's why we have markets, right? That's why we have public markets. Allocation function and consumers voting with their feet, especially for consumer brands saying I want more of this, I want less of that is actually a proper capital allocation. Like if the company did this, I would spend more money with them. That should encourage capital allocation. This is not.

Some people have like this negative perception of retail investors. I think it's actually better when retail investors say I'm going to vote with my feet, I'm going to vote with my dollars. If product X or Y or brand does, does X Y or Z or brand represents Z, I'm going to spend money with them. That is a reason to allocate more capital to that company. It's fundamentally sound."

More and more, its obvious to me that Keith is right and retail has a meaningful role in identifying opportunities and mis-pricings in the markets.

It's a new world we live in; Opendoor can ride the wave or get left behind.

"The best thing ever for Opendoor would be replacing Carrie, a CEO and replacing Powell as Federal Reserve chair. Fortunately I think both are going to happen. I hope both happen in September, maybe before."

spicy!