Quick Take on Q2 2025 Offerpad Earnings

Offerpad looks like it's up big (30+%) after earnings today. Quick takeaways:

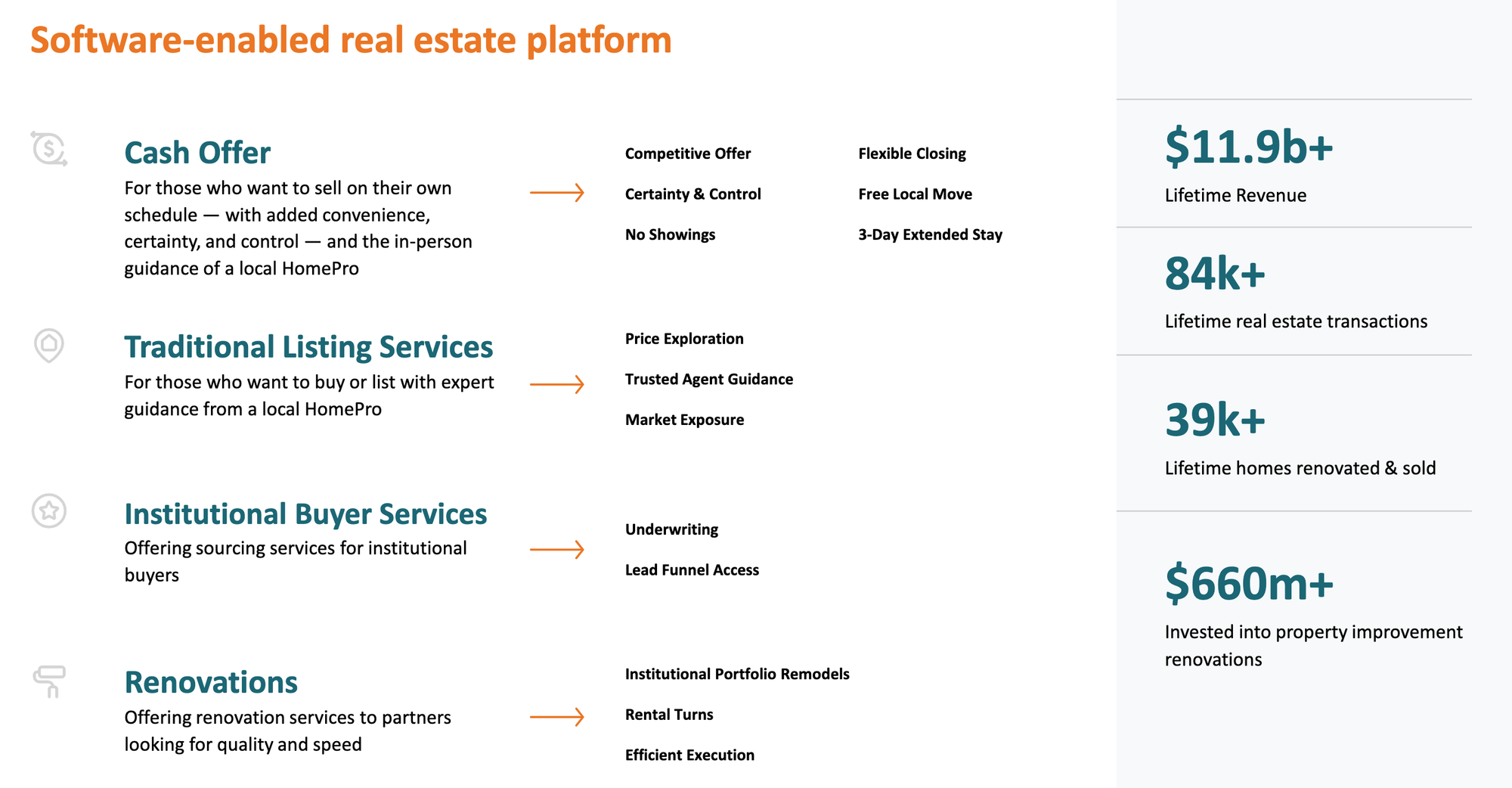

1) My guess is they're up big due MOSTLY due to reducing bankruptcy risk from $21M capital raise and highlighting a "path towards cash flow breakeven". Secondary reasons are decent Q3 resale and acquisition guide, and MAYBE continued traction from "asset-light" services (HomePro and Renovate)

2) Q3 Acquisition guide is around 400 so down about 10% from Q2. Not bad all things considered and this is in tandem of leaning more into HomePro and Renovate (ie. keeping spreads high). Seems like they're doing a lot more picking and choosing of buying homes in specific neighborhoods which makes sense at their scale.

3) No real numbers from HomePro (equivalent to Opendoor's Key Agent program) but qualitative commentary seems generally positive. Pretty dodgy answers around economics and target mix of Cash vs. HomePro. I imagine Opendoor will share a lot more around conversion lift and economics.

Final Takeaway: Offerpad seems leaning into being more of a mix between pure ibuyer platform and lower-volume, higher margin, "renovations+" player. Makes sense to me given the CEO's background but I'm skeptical can they can truly scale up meaningfully to compete nationwide (but maybe that's not their goal either). Also no mention of AI!

Overall, some signal for Opendoor tomorrow but not a ton. PLUS you can never quite predict market earnings reactions so plan accordingly.

PS: I always find it a bit "unconventional" that Offerpad always includes "Lifetime Revenue" in their investor presentation. Someone who works in their IR department please tell them to take it off...