Takeaways from Chat with Martin Shkreli ($OPEN bear)

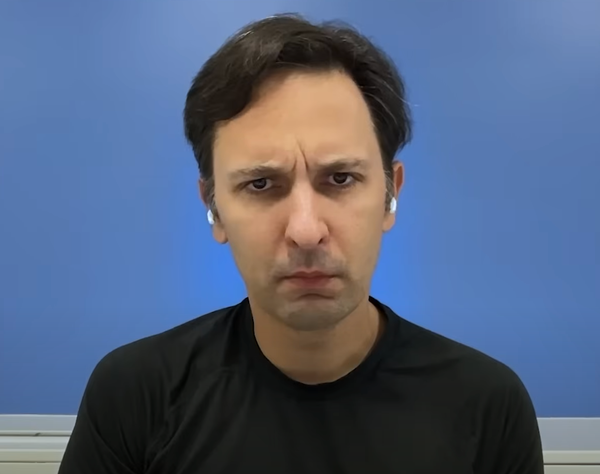

Had a chance to spend an hour with @MartinShkreli today and wanted to share my quick notes from the call. Personally, I wanted to get a sense of where his head was at (as a short) and maybe help him better understand the opportunity at hand.

Martin's bear thesis seems to revolve around:

1) $7B market cap being rich for a company in the middle of an "unproven" transformation. I think this is fair critique and honestly just based on personal judgment.

He admitted @CanadaKaz is the absolute right person for the job but thinks the execution risks aren't priced in. I made the counter that if you believe in the potential in AI to transform the business, the team, the brand, and 10+ years of operating experience - then the valuation doesn't seem out of line to me.

2) Belief that retail enthusiasm will fade and move onto the next thing (as it did for AMC). THIS IS UP TO US! I personally don't see enthusiasm waning any time soon. If anything, it's accelerating.

Ironically he made some very good bullish points as he started to better understand the business.

3) Made a very bullish comment around how institutional money is watching Kaz and $OPEN closely given how much money $SHOP has made them (50x bagger over 10 years). A very interesting point that I hadn't thought about at all.

4) Potential for ancillary services is huge, even if core ibuying business is just breakeven - quote: "this is getting me thinking of all the opportunities and that's probably not good for me as a short..."

Lastly, I told him there are too many positive catalysts in the future to be short and that housing demand is slated to bounce back hard. Better to stay out of it and maybe even go long if the "transformation" proves out.

Let's see his next move.