Top 3 Takeaways from Opendoor's Q2 2025 Earnings

Exciting stuff with Carrie joining X and tweeting for the first time ever, should be interesting times ahead.

...but let's get back to the fundamentals.

Here are my Top 3 Takeaways from Opendoor's Q2 Earnings

1) Key Agent and Cash Plus Are Working Well... Really well

"On the strength of these results, we've gone from pilot to full rollout in record time"

"Our [commission] share is at the high end of industry standard because our lead quality, frankly, is so strong and high converting."

"We've had a ton of inbounds from agents who understand what this could mean for their business, ... They understand the quality of our leads. We are putting them in the home. That is not a lead you get somewhere else. It's totally differentiated."

Carrie's never been one to brag so when she uses language like this, I think it's safe to say that there's something good happening.

Why is this working so well? I think simply because Opendoor can offer both high-intent lead flow AND to be the "buyer of first / last resort."

For anyone who's tried to request an offer from Opendoor, it's not a trivial process. It requires a lot more intent and motivation than just checking your home's estimated value on Redfin and Zillow and that's exactly why the lead quality is so good - these are people who ACTUALLY want to move.

Additionally, Opendoor can offer both agents and sellers something that Zillow and Redfin simply can't - a guaranteed offer backed by their iBuying business.

What was formerly Opendoor's albatross is now its biggest moat - the chances of Zillow starting an iBuying business to compete with Opendoor's Key Agent program are essentially zero.

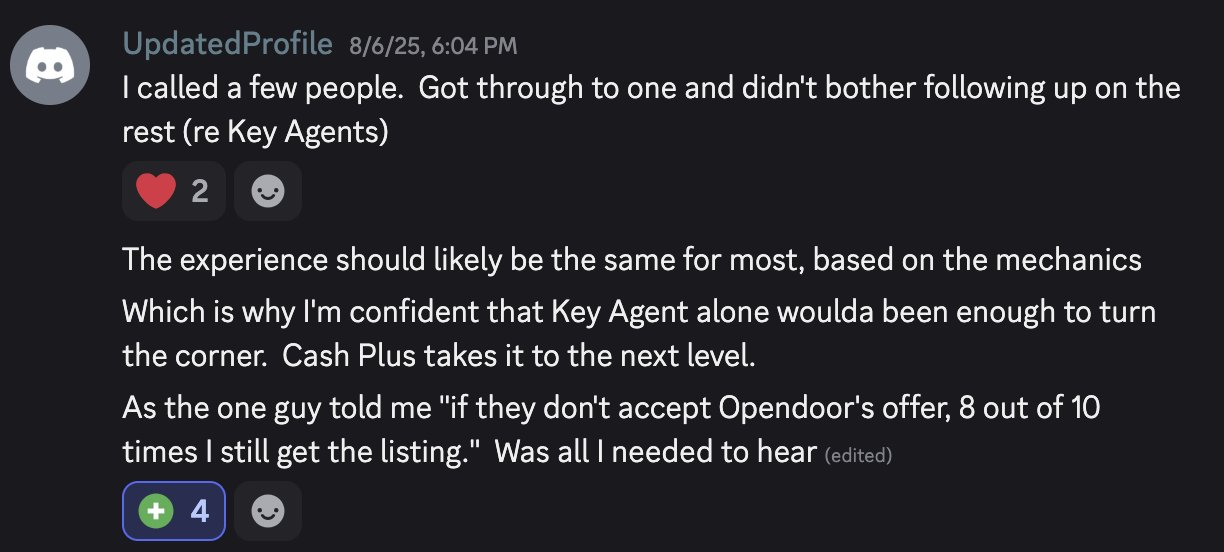

For those who don't follow me on X, a Datadoor member UpdateProfile did some diligence, actually talked to a Key Agent and came away very bullish. It seems like once the agent has built the relationship with the Opendoor lead, there's stickiness there ("8 out of 10 times I still get the listing") - which means, with Opendoor's Cash Offer, it's essentially $$$ in the bank for the agent - hence Opendoor's "top-end" commission take.

2) But What is the Ramp?

"We have been ramping into key connection markets throughout the last quarter or so. now live in every single market, but certainly ramping. Our next phase is optimization, more agents, better tools, better training, and more products."

It's unlikely the street is currently giving Opendoor any credit for the business model pivot given that management declined to give any guidance around profit or margin impact for 2025.

I did some basic back-of-the-envelope math and, with relatively conservative assumptions, even at 2025's scale of est. 11000 homes sold, Key Agent could be a $70M profit business.

This is assuming though that ALL offers are routed to Key Agents and they have the capacity to support that volume. I'm not sure what that ramp looks like; but, again we can do some quick math.

1) If we assume a top agent team can do 50 transactions a year

2) 2.5x conversion to the 11000 homes sold = ~28000 "Key Agent" transactions

3) Doesn't make sense to stuff 50 deals through a team that's at max capacity so let's assume we're bringing the average agent from 25 to 50 transactions a year = 25 Incremental Key Agent Transactions / Agent

4) 28000 Transactions / 25 per Agent = ~1100 Agent Teams needed to be onboarded to support current scale and add ~$70M in profit dollars.

That feels aggressive but reasonable? Onboarding 20 teams a week? Or maybe 10 a week and it takes 2-ish years to get to full scale?

Certainly a big hill to climb but not out of the realm of possibility.

3) There is Macro Upside Not Baked into the H2 Plan

"This time it's different" - Every $OPEN bagholder

Lastly, I do want to make a quick point around macro and guidance. Obviously the earnings call language was that there is essentially no macro upside baked into the guidance. In fact, it seemed like the analysts on the Q&A WANTED Selim or Carrie to be a bit more aggressive on spreads but they held resolute (of course).

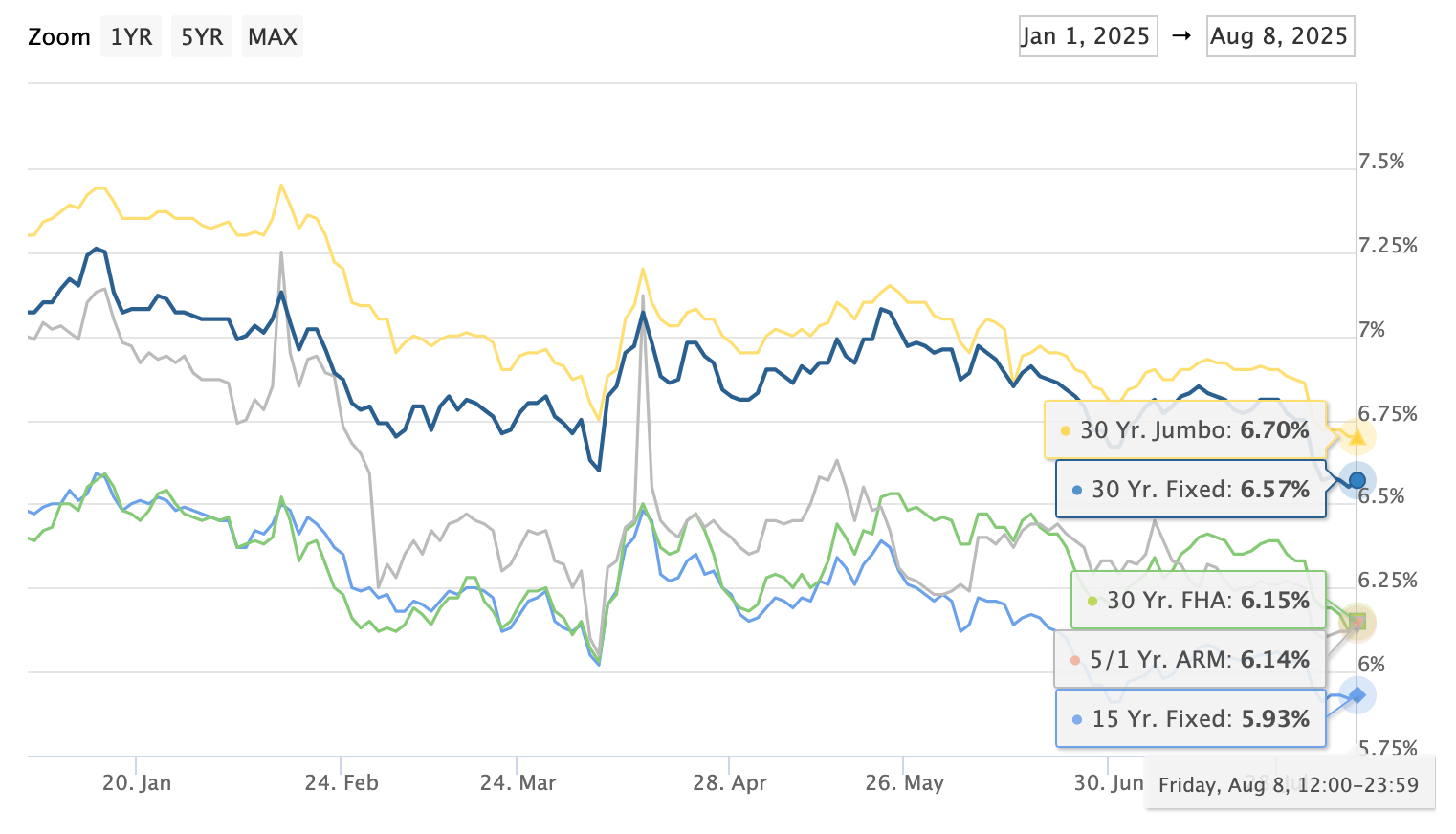

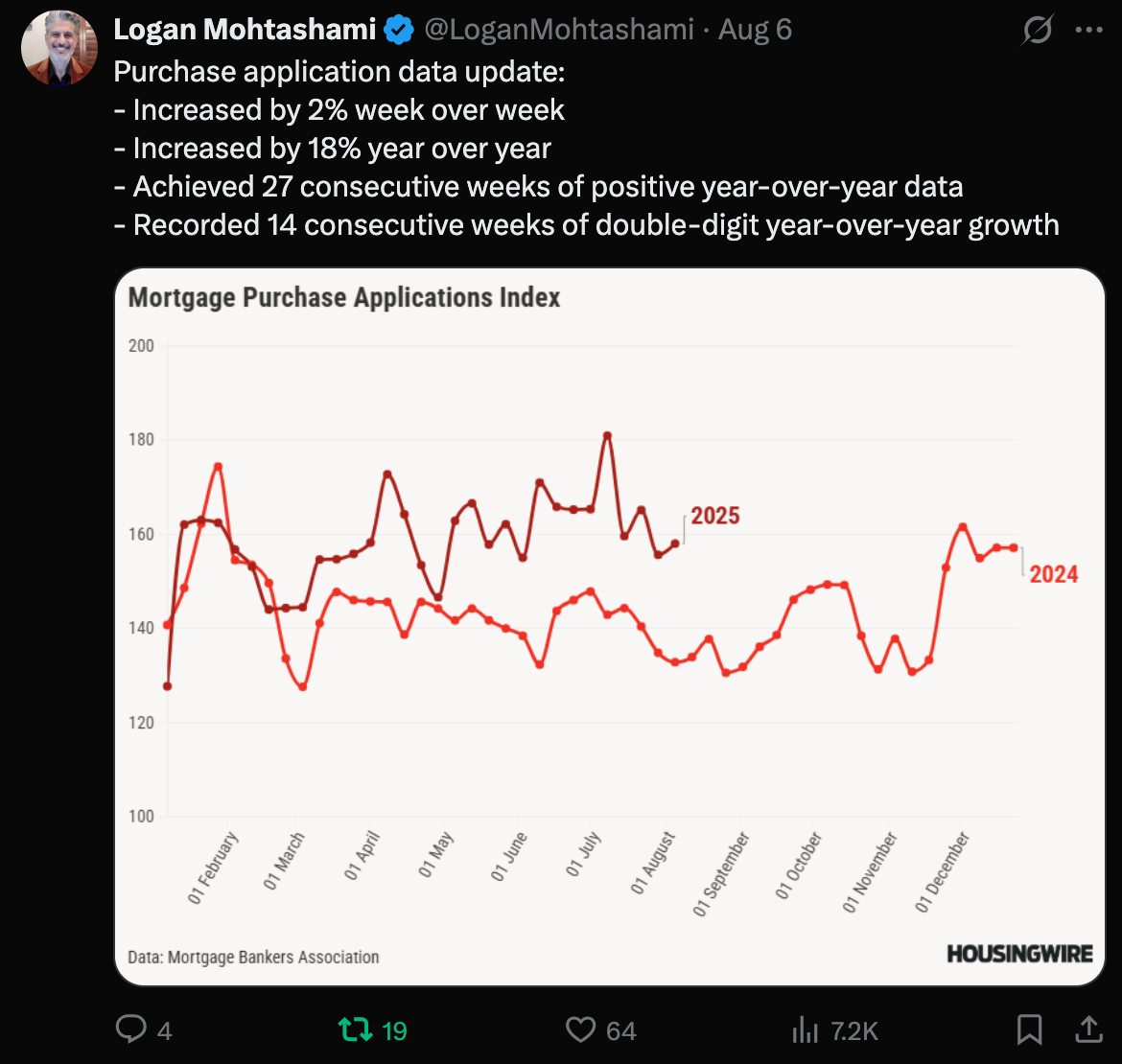

I think this is honestly why the stock tanked after earnings BUT I do feel like the worst is behind us in the housing market. Mortgage rates are at yearly lows and economic data seems to be trending down, pointing to more rate cuts this year and next (with a friendly push from POTUS of course).

I've had this feeling before and been wrong so we'll just have to wait and see. I think though housing is LONG overdue for a bounce back and it's only a matter of time.

Please subscribe if you liked this article and want to learn more about Opendoor

I've been a die-hard Opendoor follower, employee, and shareholder since I joined the company in 2016. In many ways, the company has defined my professional and personal career. Currently, I work at DeepSky (founded by former Opendoor alum) where we're building the next business super-agent.